ct sports betting tax

The passage of the regulations for sports wagering and online gaming is a significant step forward for Connecticut and our partners in. Online casino gaming and sports betting has been live in Connecticut since Oct.

What Is Sports Gambling And How Will It Change Connecticut Hqnn Org

This rate applies equally to both the tribes and the lottery though the latter is apparently seeking to.

. Since PASPA was repealed by the Supreme Court in 2018 Connecticut has yet to push legislation that would bring sports betting to casinos. The companies will pay an 18 percent tax on online gaming revenues for the first five years of operation and then 20 percent in the years after. From the start lawmakers pushed to let the Native American tribes take the lead on sports betting but the state would still collect tax revenue and could offer online sports betting as well.

Since then quite a few have come on board. CT Sports Betting Regulations. 12000 and the winner is filing separately.

Have you ever wondered about online sports betting taxes. Another week another stop in a committee for a Minnesota sports betting bill. Mohegan Digital took in 123 million in wagers and paid.

The deal also calls for a separate 1375 tax rate on sports betting. Sports betting taxes fluctuate based on overall income and can be more or less than 24 depending on earnings overall. 13000 and the winner is filing single.

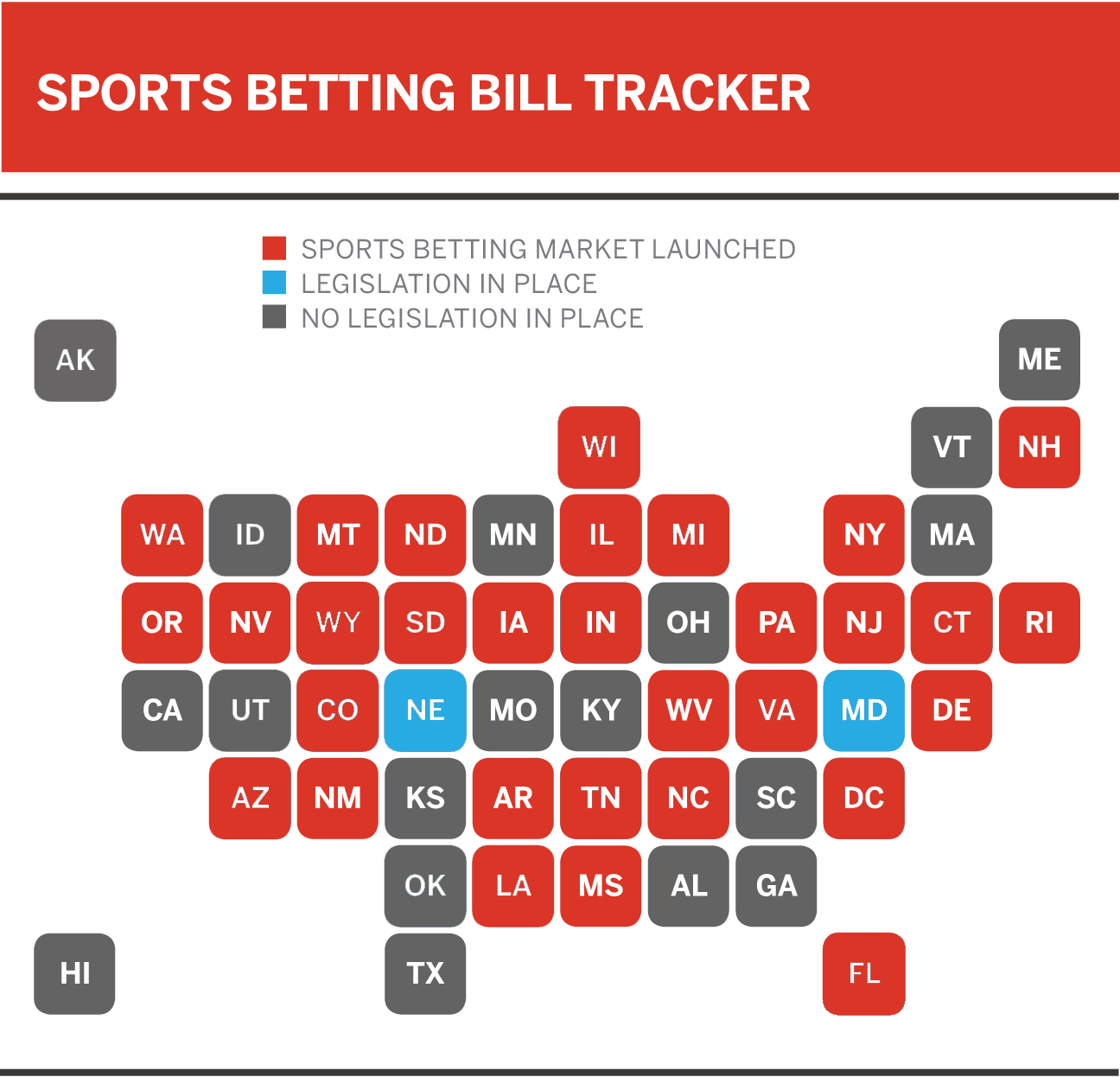

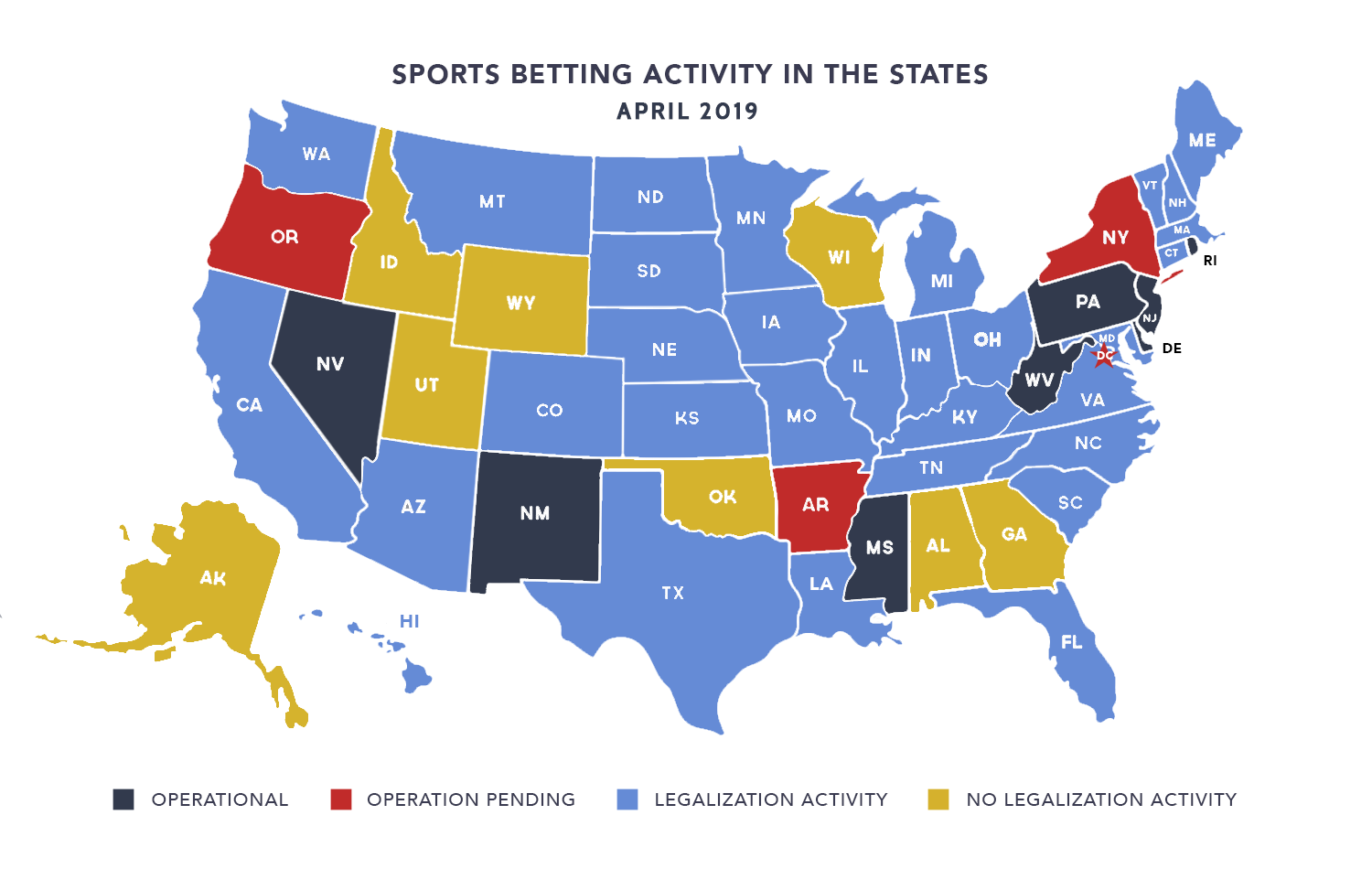

19 and the state reported that its tax coffers gained a total of 17 million in about a half-month of betting under the new system on a total of 366 million in wagers. The bill which aims to legalize retail and mobile sports betting heads to the House. Sports betting is now legal in West Virginia Mississippi New Jersey Pennsylvania and Rhode Island.

Sports Betting Taxes 2022. The enabling bill for the new tribal compacts agreed to by the state government and gaming tribes. The PlaySugarHouse Sportsbook service is operated by Rush Street Interactive CT RSI CT an affiliate of a US-based casino group Rush Street Gaming that owns and operates several leading land-based casinos in the US including the Des Plaines-located Rivers CasinoThe RSG group has been developing land-based casinos in North America since 1996 and fully understands the.

Of that revenue total 501516 went to Connecticuts coffer as sports. Commonly sports betting operators have revenue known as hold of 5 percent of the handle which means that for every 100 you wager the operator takes 5 of which they must pay taxes and expenses. It would seek to authorize legal sports betting in Connecticut.

A winner must file a Connecticut income tax return and report his or her gambling winnings if the winners gross income for the 2011 taxable year exceeds. Connecticut raked in more than 4 million in revenue from its nascent online gambling and sports wagering industry in November the first full month of legalized betting. Nonetheless while sports betting is illegal in a large portion of the US this doesnt get you off the hook of paying taxes.

Connecticut Income Tax Treatment of State Lottery Winnings Received by Residents and Nonresidents of Connecticut - IP 201128. While the bill legalized sports betting it had no language that made for a regulated sports betting market that Connecticut lawmakers could tax. Connecticut lawmakers set the sports betting tax rate at 1375 percent regardless of whether the gross gaming revenue GGR is derived online or at a land-based location.

The taxman may be coming for your winnings. Sportsbooks Still Chip In Half A Million In Tax Revenue. Two bills introduced in the state Senate to facilitate the legalization of CT sports betting died in committee.

Both sports betting and online gambling would be limited to those 21 and older. The most important thing to note is that sports betting winnings of any size are required to be claimed on income tax filings. Attention sports bettors.

The federal tax on that bet is 025 which results in an effective tax rate of 5 percent of GGR and even more of actual revenue. Connecticut sports betting bills 2021. Since legal sports betting is a relatively new industry many are confused about the tax laws and regulations surrounding the industry.

Osten co-chair of the Appropriations Committee told CT Examiner that legislators expect about 80 million in. No matter if you are a casual or a professional bettor the Internal Revenue Service IRS will tax your winnings. In a New Jersey case that paved the way.

Connecticut will impose a fixed tax rate of 1375 of gross sports betting revenue putting it in the middle of the range among US states with legal wagering. Keeping this in mind will help with meeting your tax obligations and avoiding being surprised when money is still owed while claiming taxes later on. First the newly-authorized operators would likely have their adjusted gross gaming revenue taxed at the current rate of 51 percent the highest tax.

Sports Betting And Taxes Paying Taxes On Your Sports Betting Winnings. All counties in Indiana also levy a local income tax. The companies will also pay a 1375 percent tax on sports and fantasy sports betting.

The Supreme Court gave states the right to legalize sports betting in 2018. 24000 and the winner is filing. 19000 and the winner is filing head of household.

Gamblers are usually unaware that sports betting winnings can be calculated as a taxable income. The states tax coffers gained about 25 million from online casino gaming and about 17 million from sports betting last month on a total of 823 million in wagers. And third you ask about the legal consequences of legislation creating a request for proposal process for sports betting or casino gaming.

HF 778 introduced by Rep. 146 was filed in January by 17 lawmakers. Over 42 billion has been legally bet on sports since betting expanded into more states in 2018 and the industry is still.

The Connecticut Lotterys sportsbook fared worse in February generating 443848 in online sports betting revenue and an additional 358165 in retail sports betting revenue for a total revenue figure of 802013. Zack Stephenson passed through the House Taxes Committee on Thursday afternoonThe bill has now passed through four House committees and its headed to another. The Indiana sports betting tax rate is 323 which is pretty reasonable when compared to the betting tax charged by some other states.

Online casino games online were a lot bigger than sports betting.

New York Sports Betting Licenses Going To Fanduel Caesars 7 Others Sportico Com

When And Where To File Your Tax Return In 2018 Tax Return Tax Paying Taxes

The United States Of Sports Betting Where All 50 States Stand On Legalization

Assessing State Sports Betting Structures Aaf

Four Sports Betting Apps Are Expected To Launch In Ny On Saturday

Online Sports Betting Sites Sports Betting Betting National League

Sports Online Gambling To Start In October Ct News Junkie

The Best Guide For Sports Betting Taxes What Form Do I Need Ageras

Connecticut Nets 4m In First Full Month Of Sports Betting

Tennessee Online Sports Betting Which Mobile Sportsbook App Is Best

Sports Betting Will Begin Early In Nfl Season After Connecticut Lottery Picks Vendors To Run Online Gambling And Sports Betting Venues Hartford Courant

Five Things To Know About Legalized Sports Betting In Connecticut

Sports Betting Vs Netflix Which Costs You Less

Online Sports Betting Grows Rapidly In Latin America Yogonet International

Louisiana Online Sports Betting 6 Best Sportsbook App Promos

December Gambling Revenues Show Online Casino Gaming Trumps Sports Betting Connecticut Public

Regulators Move To Determine New York Online Sports Betting Licenses

The Best Guide For Sports Betting Taxes What Form Do I Need Ageras

Gambling Pays Out A 38 Billion Bonus To Tax Collectors Winning Lottery Numbers Lucky Numbers For Lottery Lottery Numbers