how to pay late excise tax online

ATL - Lates Tax Financial News Updates. Customers of tier1 integrated retailers Massive increase in profitability of listed companies State Bank releases Annual Payment.

Online Bill Payment Town Of Dartmouth Ma

You may also Pay By Phone.

. Any bills not paid past the demand date may be submitted to Kelley and Ryan. Its fast easy and secure. Late returns or payment are subject to penalties and interest.

If you file Form 5330 on paper make your check or money order payable to the United States Treasury for the full amount due. Live Operators will be available to take payments by phone from 830 AM until 5 PM Monday through Friday. For Vehicles on the road January 1 that have paid an excise tax in the prior year those bills are generally issued by February 15.

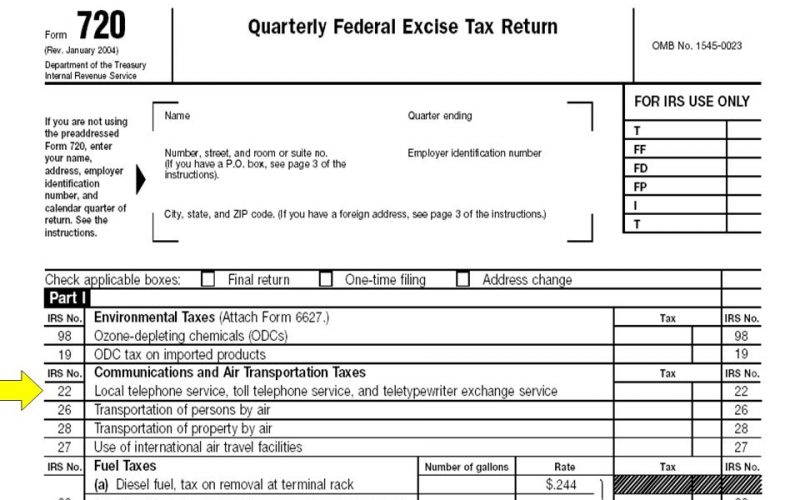

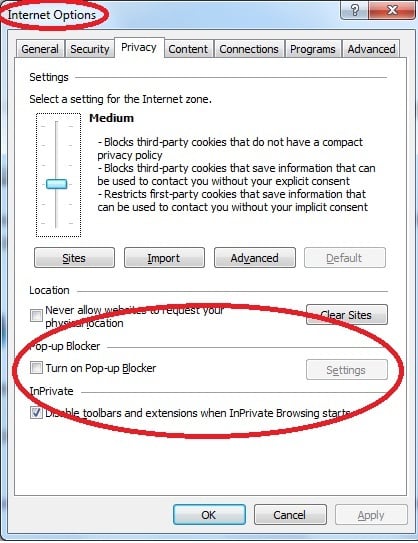

This includes Forms 720 2290 8849 and faxed requests for expedite copies of Form 2290 Schedule 1. The service fees for pay-by phone are the same as indicated above for paying online. Do Your 2021 2020 any past year return online Past Tax Free to Try.

TTB Excise Tax Returns and payments must be mailed to. FLAGGED bills will take up to 1 BUSINESS DAY to electronically clear at the RMV. Ad Avalara excise tax solutions take the headache out of rate determination and compliance.

Free Case Review Begin Online. If you wish to use the pay-by-phone service please call toll-free. You may also call Kelley and Ryan for past due amounts 800-491-9788.

If your excise tax payment is late you must pay additional penalties and interest based on the amount of taxes you owe. After receiving your bill you should fill out the necessary forms including the payment option you want to choose. For filing help call 1-800-829-1040 or 1-800-829-4059 for TTYTDD.

A heavy highway motor vehicle with a taxable gross weight of 55000 pounds or more must file Form 2290 and pay the Heavy Highway Vehicle Use Tax. Pay at least 90 percent of the tax due by the original due date of the return and. Avalara solutions can help you determine excise tax and sales tax with greater accuracy.

There is no statute of limitations for motor vehicle excise bills. Payment at this point must be made through our Deputy Collector Kelley Ryan Associates 508 473-9660. Tax on Property vehicles.

Pay the balance of the tax when you file within the extension period and. To make online payment of Motor Vehicle Excise Bills you MUST enter the Last name AND the Plate Registration number of the vehicle you need to pay. Attach the payment to your return.

ATL - Lates Tax Financial News Updates. File at the address shown under Where To File earlier. Excel Workbook of the General Excise Tax ExemptionsDeductions by Activity Code as of June 20 2022 XLSX.

Click here to visit the UniPay Online bill pay center. Be sure to complete each screen to process your payment. The tax collector must have received the payment.

Pay any interest due when you file or within 30 days of our billing notice. See reviews photos directions phone numbers and more for Pay Excise Tax locations in Piscataway NJ. Pay your real estate taxes from the convenience of your home or office 24 hours a day 7 days a week.

Your TTB Specialist will assist you in calculating the penalties and interest. Here you will find helpful resources to property and various excise taxes administered by the Massachusetts Department of Revenue DOR andor your citytown. Bills not collected on time must be charged interest and late fees according to Mass Law.

You are personally liable for. Bills not paid eventually will have a lien recorded against the. Failure to File Penalty.

Dont File Duplicate Excise Tax Forms Paper excise forms are taking longer to process. WE DO NOT ACCEPT CREDITDEBIT CARDS AT ANY OF OUR WALK-IN LOCATIONS. Easy Fast Secure.

If you do not have a bill number you can also pay the tax online by using your social security number. Online tax payment transactions are handled over a secure network and processed by. Excise Bills are issued numerous times throughout the year when received from the Registry of Motor Vehicles and are due 30-Days after the issue date.

Simply The 1 Tax Preparation Software. They also have multiple locations you can pay including Worcester RMV Leominster RMV and other locations listed on their website. Bills will only be available to pay online through the actual due date.

20 percent late filing or failure-to-file penalty on tax not paid in full by the original due date and the. Ad Do Your 2021 2020 2019 2018 Taxes in Mins Past Tax Free to Try. County Surcharge on General Excise and Use Tax.

Massachusetts Property and Excise Taxes. Easy Fast Secure. What happens if you pay your excise tax late.

To find out if you qualify call the Taxpayer Referral and Assistance Center at 617-635-4287. Write your name identifying number plan number and Form 5330 Section ____ on your payment. An Introduction to the General Excise Tax PDF 20 pages 136 KB March 2020.

You Answer Simple Questions About Your Life We File Your Return. Personal Property and Motor Vehicle Excise tax bill warranted for collection is collected in accordance with the the laws of the Commonwealth of Massachusetts. THIS FEE IS NON-REFUNDABLE.

You can also contact your employer or payer of income. Not just mailed postmarked on or before the due date. Ad See If You Qualify For IRS Fresh Start Program.

If your excise tax return is late you must pay a penalty based on the amount of taxes you owe. Discover and Mastercard credit card payments are. In the Activity screen you will need to select the type of payment you are making from the drop-down menu.

Your payment will be debited directly from your checking account without any additional processing fees. Tax Facts 37-1 General Excise Tax GET Other Tax Facts on General ExciseUse Tax. Online Payment Search Form.

Based On Circumstances You May Already Qualify For Tax Relief. If you dont make your payment within 30 days of the date the City issued the excise tax interest and fees are added to your bill. First you must obtain your bill number and the fiscal year.

Please note all online payments will have a 45 processing fee added to your total due. Try It Yourself Today. You can then proceed to pay your taxes online.

Federal Budget 2022-23 FBR issues clarification on FMCG Late Return Filers Can Join ATL After Payment of Surcharge Rupee strengthens against dollar FBR POS Lucky Draw Today 15 July 2022 Steps to. A motor vehicle excise is due 30 days from the day its issued. And Prices Federal Board of Revenue alerts Taxpayers about Fake and Harmful Emails FBR extends date for filing.

Look Up Pay Bills Town Of Arlington

Excise Tax What It Is How It S Calculated

The Real Deadline For Depositing 401 K Deferrals And What To Do If You Re Late Www Patriotsoftware Com Payroll Software Deposit Employment

Form 720 Excise Taxes Instructions And Guidelines

3 11 23 Excise Tax Returns Internal Revenue Service

Pin By Karthikeya Co On Tax Consultant Indirect Tax Custom Last Date

Combined Excise Tax Return Deduction Detail Washington Department Of Revenue

New Gst Registration Procedure Gst Number Blog Tools Registration Confirmation Letter

Online Bill Payments City Of Revere Massachusetts

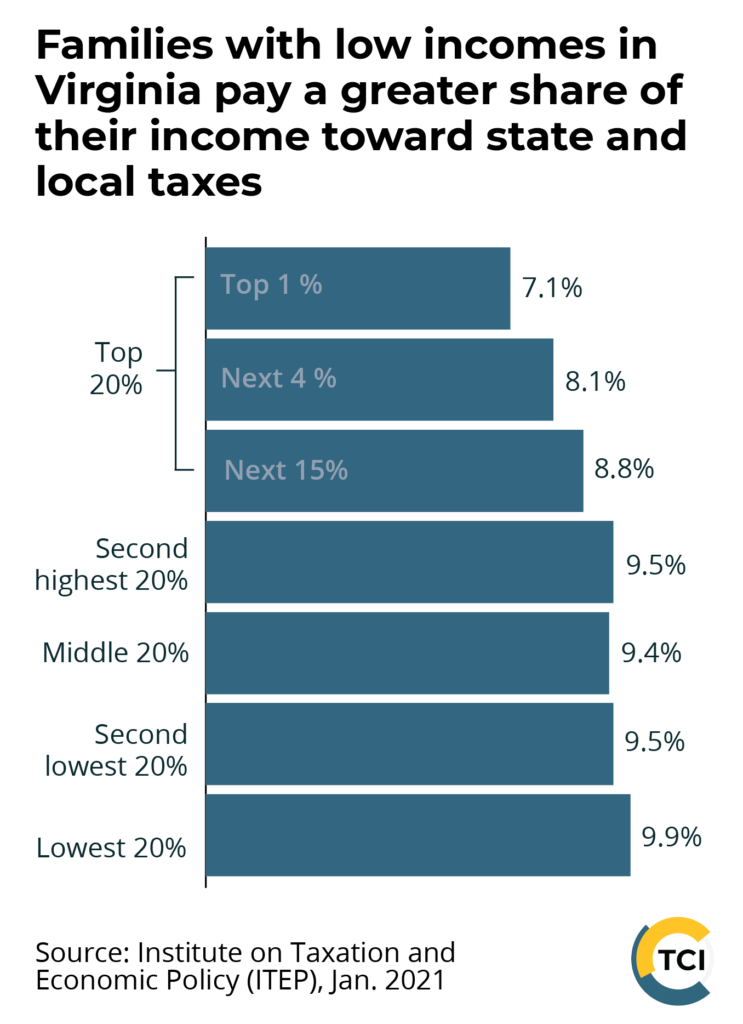

Tax Policy In Virginia The Commonwealth Institute The Commonwealth Institute

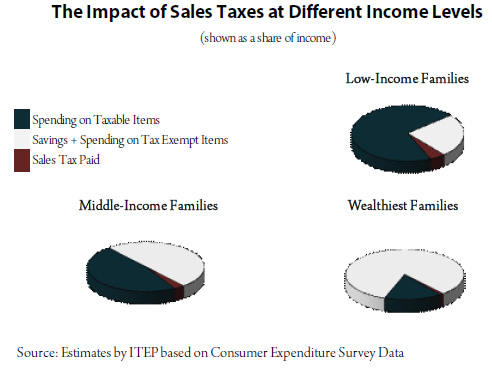

How Sales And Excise Taxes Work Itep